Mastering Traditional and AI-Driven Content Marketing Strategies

AI is more than a buzz-worthy tool.

It’s a time-saving machine.

Here’s how I cut my time spent drafting an article in half with the help of artificial intelligence (AI).

I used to follow the traditional approach to content marketing.

Prior to AI, I performed manual research to draft a comprehensive outline, conducted keyword research using a separate tool, then spent an ample amount of time drafting the content.

Then, I would have to take the time to edit for grammar, structure, spelling and logical flow.

This entire process took me about eight hours total.

Now, with the help of AI, this entire process only takes me four hours total. I leverage AI for time-savings by asking it to accomplish the following tasks for me:

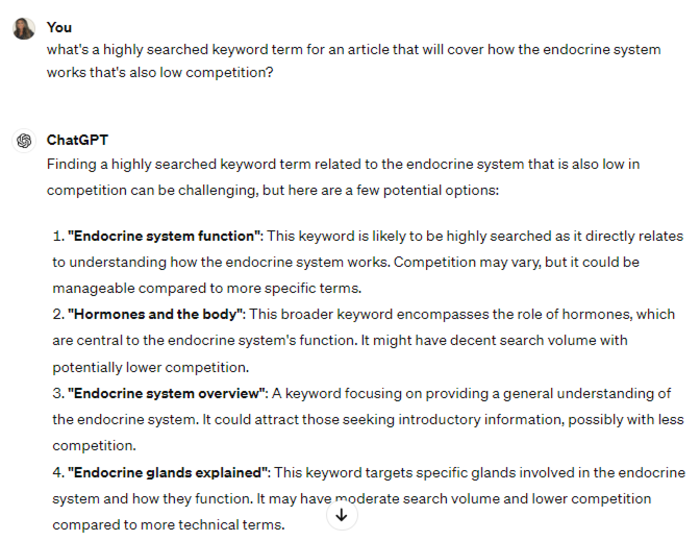

- Conduct Keyword Research: I ask Generative AI to look for low-competition, highly-searched terms related to my topic of interest. I double-check its results using SEMrush, however, you can defer to your keyword tool of choice.

- Create Outline: Next, I prompt AI to create a comprehensive content brief that uses the focus keyword, has a unique angle, and differs from what’s already ranking.

- Draft Content: I’ll then draft the content based on the content brief AI has created for me. This is where the manual work comes in as I don’t rely on AI to draft the actual content for me. This ensures the content is original, not duplicated, and uses my voice.

- Edit Content: Once I’ve finished writing the content, I’ll ask AI to provide me feedback in terms of grammar, spelling, conciseness, logical flow, audience relevance (tell AI who your target audience is), and overall impact.

- Revise Content: I then perform a final revision of the content based on the edits AI suggests. Keep in mind not all edits it suggests will be accurate or relevant.

That’s all it takes to drastically reduce the length of time it requires to draft a high-quality article.

Let’s further explore more AI-driven content marketing strategies to amplify your efforts.

Sample keyword research using Generative AI

Sample keyword research using Generative AI

How Traditional Marketing Has Evolved to Include AI

Rank-worthy digital content has drastically evolved to blend a unique mix of both traditional and AI-driven content marketing strategies.

Rank-worthy digital content has drastically evolved to blend a unique mix of both traditional and AI-driven content marketing strategies.

Businesses and content creators alike once relied heavily on crafting content without the use of tools or technology, however the tides are shifting.

Now, content creation is increasingly turning to AI to help outline, create, distribute and envision engaging copy.

Levering the power of AI can help streamline the content creation process and discover opportunities to enhance content for search engine optimization (SEO).

This article will explore how digital creators can master a mix of both traditional and AI-driven content marketing strategies to outrank competitors.

We’ll explore the tools and tactics content marketing experts rely on to help them achieve top-notch results amid an increasingly competitive digital landscape.

From understanding user intent to drafting quality content, AI-driven strategies are helping businesses better reach their target audience.

They’re also compelling them to take meaningful action that make content initiatives worthwhile.

In this article, we’ll also cover many emerging topics that you can listen to more in-depth on the UNmiss podcast so be sure to check back often for more useful audio content that covers a variety of digital marketing topics.

How AI is Transforming Content

AI is increasingly becoming more intertwined with content creation and emerging as a powerful aid.

Before AI, writers had to rely on a variety of tools to perform keyword research, create optimized content briefs, conduct research, and draft the content.

AI eliminates the need for multiple tools and can help facilitate all of the previously mentioned.

Because of this, it is streamlining content creation processes and producing significant time savings for writers.

For example, in the past creators used to have to turn to a keyword research tool to identify low-competition, high-traffic keyword terms to incorporate in their content.

Now, creators can turn to AI and ask the technology to find this information on the writer’s behalf with a short, simple prompt.

In turn, the writer is delivered nearly instantaneous results to help guide the content creation process.

From keyword research to delivering appropriate section headers, AI is reshaping traditional content marketing strategies and uncovering quicker ways to resonate with consumers.

Adapting AI-Driven Content Practices for SEO

In the context of SEO, AI-driven content practices are a must to help maintain a competitive edge and show up at the top of the SERPs (Search Engine Results Pages).

AI can help content marketers parse through vast amounts of information and identify key points.

This allows content creators to draft relevant and engaging content tailored towards the specific intended audience.

Research and outlining become simpler, allowing content creators to focus on writing content that attracts and retains visitors.

However, it’s important to note AI’s limitations in terms of creating short and long-form content.

While AI is a powerful tool to augment the content creation process, it shouldn’t be used to solely draft the content.

Manual copywriting remains a must despite advancements made in AI technology.

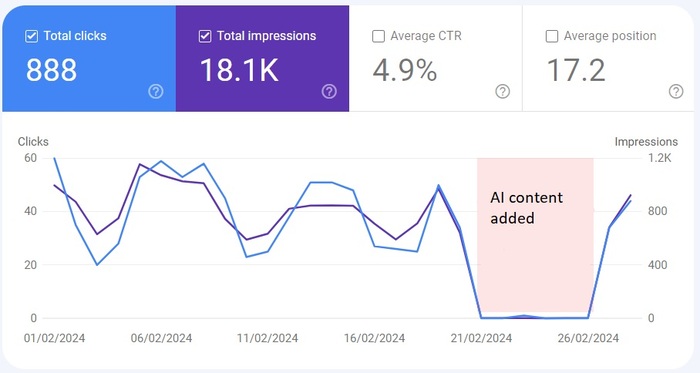

A recent case study found that when replacing the introductory paragraph with AI-written content, the web page saw a significant drop in traffic despite the majority of content being human written.

The page went from receiving around 40 clicks a day to 0.

The website owner then reverted the AI-written introduction paragraph to content written by a human, resubmitted the URL to Google for indexing, and was able to see higher organic search traffic return to the page.

This case study highlights the need for human-written content and proves Google is searching for and penalizing web pages that have AI-generated content.

The Balance Between Manual Copywriting and AI-Driven Content

AI offers a plethora of benefits, such as efficiency and scalability, but manual copywriting has numerous advantages as well.

To start, manual copywriting adds a human touch, evokes emotion, and strays from complex language.

It allows for creativity and authenticity that is unmatched. It can also help brands maintain a consistent voice and tone across their content.

On the other hand, AI’s ability to digest information is unmatched. AI scans through websites’ content in a matter of seconds and delivers nearly accurate results.

It’s important to note that information AI returns has the potential for bias so it’s crucial to always fact check.

It can help marketers interpret data and better understand their audience’s desires, allowing for more tailored and targeted content.

Utilizing a mixture of traditional (manual copywriting) and AI-driven content marketing strategies is the most streamlined path towards success.

AI shouldn’t be seen as an end all be all but rather a useful tool to complement existing content efforts.

Despite its limitations, it’s still worthwhile to include in any business’ technology stack.

Generating Revenue Through Content Marketing Initiatives

Content marketing can be one of the most lucrative facets of digital marketing when done right.

This is why it’s crucial to be able to attribute content marketing performance to revenue to ensure your business can properly tie your efforts to sales.

A podcast interview with Trevor Longino, a growth content marketer and startup founder, explores how to turn content marketing into a revenue generating machine.

Longino shares strategies on how to become more strategic with content creation and distribution.

Many of these strategies align with traditional practices although AI can be leveraged to help. A few of his strategies include:

- Calendaring: Longino recommends creating and maintaining a content calendar to identify when content where be published, where it will be distributed, the sales funnel stage it targets, and the intended audience. This allows content marketers to identify any gaps in content efforts.

- Conversion Optimization: Every piece of content produced should have a goal, whether it be to encourage newsletter sign ups, visit a product page, or take some other form of action. Content should be created for a purpose.

- Personalization and Segmentation: Not all content is created equal. Create a diverse portfolio of content that attracts different audiences you target and their interests.

- Improving Content Quality: If you’ve had content existing on your site for many years, it’s unlikely every piece of content is optimized. Go back to older posts that may have outdated or unhelpful content and repurpose it to be more useful.

- Identifying Key Metrics: Have a firm understanding of the metrics that matter most to your business related to content marketing such as organic search traffic, engagement, conversions, leads, and more.

- Distributing Your Content: A good content distribution plan is a must. This helps your content receive more eyes on it. Determine the channels where your target audience spends the most time and plan accordingly.

How AI is Assisting with Content Revenue Generation

AI is pushing boundaries across multiple facets of digital marketing and content generation, including adding to the bottom line.

In its traditional use, many view AI as an assistant for topic generation, content optimization, and producing content for a variety of marketing campaigns.

However, as podcast guest Tom Winter shares, AI can also be a powerful source for assisting with revenue generation in the content marketing realm.

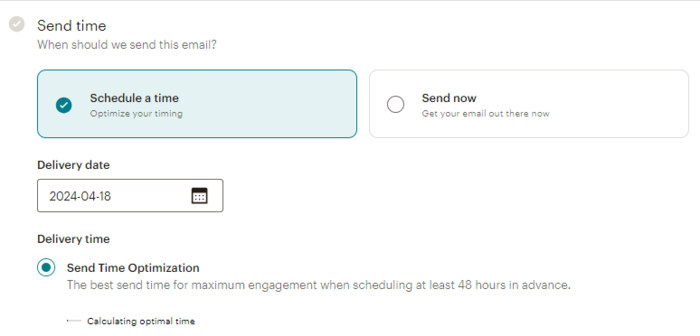

For example, AI can help optimize ideal email send times to deliver more relevant content at a high engagement time.

AI algorithms analyze historical data and user behavior patterns to determine when it’s best to send an email.

This helps ensure recipients open your message and consume the content you’ve worked hard to create.

It also allows for more personalization to help improve email open rates, click-through rates, and conversions.

Example of an AI-powered email calculation for optimal send time

AI-powered content recommendation engines can help promote related items or prompt upsell opportunities.

This helps boost the average ticket item cost and encourages customers to see the breadth of products or services your business offers.

Over time, these types of recommendations can contribute to incremental revenue growth and help boost business growth.

There are a variety of use cases where AI-generated content assists the sales process from first interaction with your business to the checkout page.

It’s essential to explore all the possible ways AI can help drive gradual growth in your content marketing campaigns and across different channels.

The Transformative Role of AI in Content Creation and Distribution

AI is revolutionizing content creation and distribution, making two historically mundane and time-consuming tasks much easier for content creators.

Using AI, marketers can create high-quality content more efficiently and seamless than ever before and can find appropriate channels for distribution to maximize the content’s viewership.

As today’s digital era progresses, AI content tools are becoming a necessity for businesses of all kinds to maximize their exposure and produce superb content readers are quickly becoming accustomed to consuming.

Understanding the Impact of AI in Content Marketing

To fully comprehend just how impactful AI has become in the content marketing field, it’s important to first understand its origins.

AI technology relies on natural language processing (NLP) and machine learning (ML) to interpret and produce quality results.

This advanced technology has the capability to understand complex queries and make sense of how to deliver the best response to the end user.

AI has forever transformed the content creation process in a variety of ways, most notably by:

- Automating Content Generation: Nearly every content optimization platform offers some version of AI content creation. The most well known is ChatGPT, however there are a plethora of other tools that generate content as well. AI quickly returns content based on specific inputs. This allows content creators to produce content quickly and improve their writing to better reach their target audience. As Nick Bhavsar, founder of Bhavsar Growth Consulting, told us, ChatGPT can help in the blog creation process by creating the bones of a blog post for different personas and different stages. The writer can then revise the content to match the brand’s distinct voice and tone.

- Personalizing Content Recommendations: AI algorithms analyze vast amounts of user data, pinpointing what consumers care about most. This allows AI to deliver tailored content recommendations and results that align with the user’s personal preferences. A recent study found that businesses can boost their revenue by as much as 40% by using personalization.

- Optimizing Content: AI enables content marketers to create comprehensive content briefs that align with what’s currently ranking around a certain focus keyword and can give suggestions for how to outrank current competition. In turn, this helps businesses boost their organic search visibility and mirror content closely with user intent.

However, Stephen Jeske, Editor and Curator for Growth Hacking Digest, says, “A large language model isn’t the end all be all for content creation.

You end up with a piece that ends up so generic you end up starting from scratch. A large language model can instead better be used to create content outlines.”

Leveraging AI for Enhanced Content Distribution

Content creation isn’t worthwhile without an effective distribution strategy.

You can drive organic search traffic through proper SEO, however a solid distribution strategy can help your business gain more exposure and build brand recognition.

AI can be a useful tool for assisting with ensuring your content gets to the right audience at the right time.

Here are a few ways AI can be leveraged to optimize your content distribution strategy.

Audience Segmentation and Targeting

AI-powered tools can analyze expansive datasets to segment your audience based on their demographics, previous purchasing history, behavior, and more. With this level of segmentation, marketers can tailor their content distribution strategies.

This may include sending target email campaigns based on past buying behavior, creating targeted social media ads for a specific audience, or recommending content that aligns with the consumer base.

Personalization can be beneficial especially for brands that target two or more diverse types of audiences, such as a supplement company targeting nutrition enthusiasts and athletes.

Predictive Timing

There may be a certain time of day or day of the week when it’s optimal to send your email marketing.

AI-driven predictive analytics can forecast when to send outreach based on the wealth of data it sifts through. This helps marketers improve open rates, click-through rates, and can lead to higher conversion rates too.

Automated Placements

AI algorithms can determine where it will be most beneficial for your brand to place content across multiple channels such as social media, websites, and more.

This not only ensures your content gets seen but also helps your bottom line by placing content only where it makes sense.

As Tom Jauncey and Steven Khanna shared with us in a podcast episode, manual email outreach can be difficult for content placement and some websites don’t provide contact information.

AI eliminates the work it requires to manually reach out to different websites and publications.

Dynamic Content Optimization

What’s worked well for content distribution may not always work well. With dynamic content optimization, AI continuously monitors and shifts distribution strategies if something isn’t working.

This ensures content remains impactful and continues to reach the right people, adjusting distribution methods based on audience engagement.

Content Amplification

AI-powered tools hold the power to find influential platforms and places where your content will resonate most.

It can also discover new audiences that are interested and seeking your products or services. By leaning on partnerships and collaborations, marketers are able to boost their content’s visibility and reach new people made possible by AI.

Personalization Recommendations

As we’ve alluded to, personalization is key to powering recurring purchases. Individual users want and prefer content that aligns with their own interests.

AI can sort through a vast amount of information more efficiently and swiftly than humans can.

Therefore, they’re better able to identify what matters most to different users and can help promote content with the user’s needs.

This level of personalization helps drive qualified traffic and can enhance the sales journey.

Conclusion

High-quality content creation is only half the battle in digital marketing—the other piece of the puzzle involves having a robust distribution strategy.

Otherwise, your content may never reach its intended audience, thwarting your SEO and digital marketing efforts.

To optimize and streamline content creation and distribution, businesses are turning to AI for help. And these businesses are seeing massive results from doing so.

Traditional content marketing is dead. If your business isn’t keeping up with technology you’re going to get left behind.

AI-driven content marketing strategies are crucial to adopt to maximize the impact of your digital content.

By leveraging AI for audience segmentation, predictive timing, automated placements, dynamic optimization, content amplification, and personalized recommendations, marketers are better poised to break through the noise.

AI, when used correctly can maximize content’s reach, user engagement, and conversion opportunities in even the most competitive markets.

UNmiss has a variety of AI tools to help you reach your content creation and distribution goals. Check out the many tools we offer to help boost your website’s quality and conversions.